Heavenly Homes & Families Take Faith

If you understand the importance of intentional homemaking, want to create peace in your home, and cultivate a family who loves each other, then you’re in the right place.

This is where you’ll find time-tested solutions from a mother of 5 to help you remember what matters most in life.

Grab My Exclusive Printables To Nurture Your Home, Faith, and Family.

(You’ll be glad you did)

Start building a stronger faith, family, and home today. Sign up for my email list and get access to my best resources to help you create the home you want.

Hi Friend! I’m so glad you’re here.

Do you know that feeling when you walk into a home and just feel at peace? It’s like suddenly everything just falls into place and you can breathe again.

For me, that’s what strengthening your home, faith, and family is all about because the most important relationships in your life are worth fighting for.

And I believe that if you join me on this journey, your home can be filled with loving family connections, no matter your circumstances.

Welcome friend. You’re in the right place.

Micah Klug

“No woman who understands the gospel would ever say “I am just a mother,” for mothers heal the souls of men.” Sheri Dew

Here’s the latest ideas and helps from the blog

HOMESCHOOLING TIPS

85 Summer Journal Prompt Ideas To Banish Boredom + Free Journal

A smorgasbord of sunlight, sprinklers, and seemingly endless hours of freedom stretches out in front of our children during the summer months. Yet, within this tapestry of leisure, lurks a sly villain—boredom. But there’s so many fun activities, including these […]

50 Kindergarten Journal Prompts to Spark Learning

“My dad is super strong cause he smells like broccoli. I love my dad.” I found a childhood sketch of a peach and black blurb standing next to a larger blurb of brown and red. I’m pretty sure this was […]

Free Printable Preschool Traffic Signs & Worksheets

Teaching your preschooler their shapes doesn’t need to be boring. When you grab this free preschool traffic signs printable (with worksheets) you’ll have plenty of fun shapes activities your child will love! Free Printable Preschool Traffic Signs & Worksheets In […]

CELEBRATE HOLIDAYS

19 Free Earth Day Theme Worksheets For Preschool

You’ll love these free Earth Day theme preschool worksheets and lesson plans that are ready for you to print and use on April 22nd. Included in this Earth Day Curriculum are 65+ pages of fun Earth Day activities young children […]

35 Best Preschool Books To Celebrate Earth Day

You’re going to discover the best preschool Earth Day books that’ll encourage your young readers to learn about our beautiful planet. My 5 kids love spending time digging in the dirt and exploring the world around them. And like most […]

25 Free Virtual Earth Day Activities For Kids In 2024

Earth Day is April 22nd and there are so many fun virtual Earth Day activities your kids can participate in this year! Not only will they have a great time learning about the natural environment, but they’ll also learn all […]

MARRIAGE

25 Ways To Celebrate Husband Appreciation Day In 2024

National Husband Appreciation Day is a day to celebrate your husband and show him how much you appreciate him. It is typically celebrated on the third Saturday in April, but the date varies from year to year. Let’s learn about […]

Top 205 Questions for Couples Who Want To Be Closer

If you and your spouse are looking for a fun date idea, you’re going to love asking each other these couples’ questions. You’ll find good questions, along with conversation starters and tips on how to keep the conversation going for […]

The Perfect Valentines Gift Your Husband Will Surprisingly Love

Is your man impossible to shop for? Mine is (I know the pain). The Valentine’s gifts in this guide will help you find the perfect Valentine gift for your husband he will surprisingly love. My husband’s ears flushed red and […]

PARENTING

100 Free Journal Prompts For Mental Health + Printable

In a world where people would quickly give up grandma’s secret family recipe for 5 minutes of mental peace and quiet, it’s important to take care of ourselves (and grandma). One way you can do this is by journaling. Journaling […]

21 Beautiful Poems & Quotes To Honor Stillborn Babies

I remember how cold the old cemetery in Quitman, Mississippi felt as my eyes scanned the small, stone headstone. Emma Jean – Born to be in heaven The dates were one and the same. This baby girl’s life began and […]

27 Poems For Babies You’ll Adore, Perfect for Your Baby

Congratulations on your new bundle of joy. You’re going to love snuggling and reading these beautiful baby themed poems. They’ll warm your heart and bring a smile to your face as you hope and dream for your baby’s future and […]

FAITH

Free LDS Coloring Pages For Adults: A Creative Escape

Ready to stay awake during General Conference? Well, I can’t exactly promise you this because I have a hard time focusing when there’s soft blankets and an upright foot rest on the recliner. But I can promise a creative way […]

Power Of A Woman In The Bible – Free Bible Study

There’s a special reason why God declared His creative works complete after women were created. It’s because He “saw that it was very good” (Genesis 1:31). Women throughout history have held incredible influence throughout time. But I would argue the […]

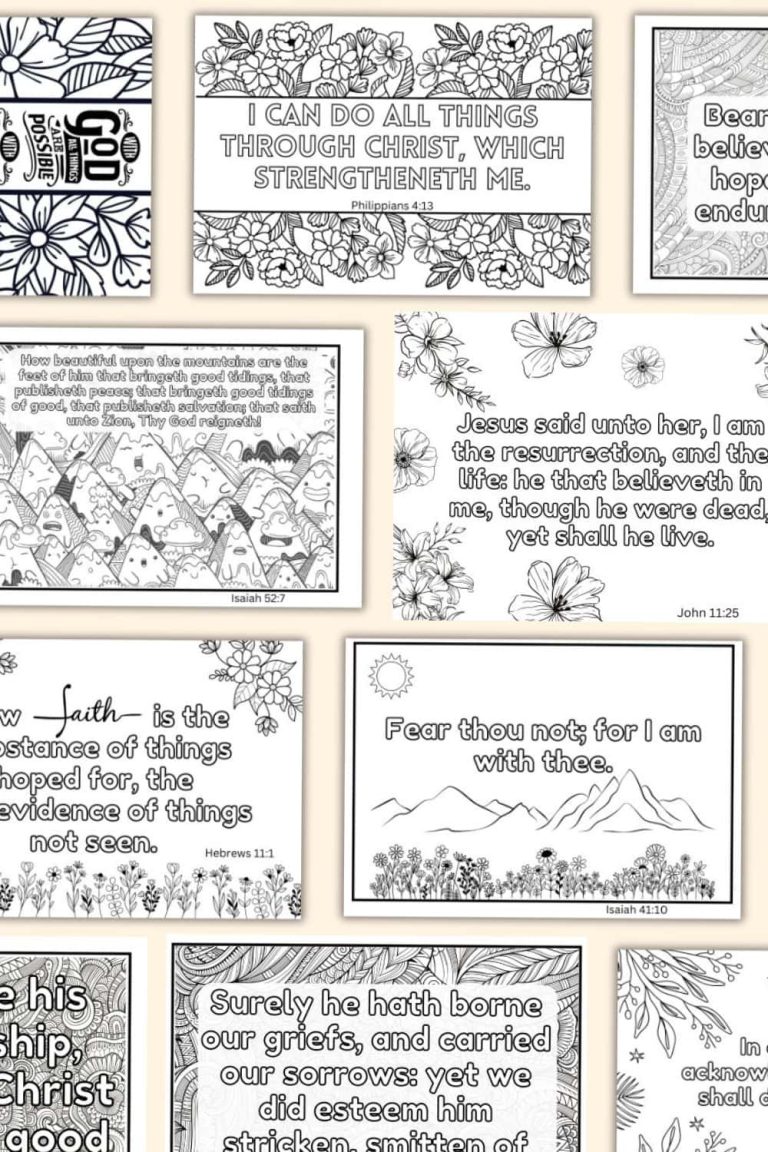

Enjoy These Free Bible Coloring Pages For Adults

You’re going to love these Christian Bible coloring pages. Each scripture comes from the King James Bible and is accompanied by a beautiful design that you can easily print and color at home. These free coloring pages are perfect for […]

LISTEN TO THE LATEST